Delving into the importance of reviewing your life insurance quote annually, this article sheds light on the key reasons why this practice is crucial. As life circumstances evolve, so do insurance needs, making it essential to stay informed and proactive.

Exploring the impact of changing factors on insurance coverage and the risks associated with neglecting regular reviews, this piece aims to equip readers with valuable insights for making informed decisions.

Why Reviewing Life Insurance Quotes Annually is Important

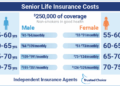

Reviewing your life insurance quotes on an annual basis is crucial to ensure that your coverage aligns with your current needs and circumstances. Life is unpredictable, and various factors can change over time, impacting the adequacy of your insurance policy.

Changing Life Circumstances

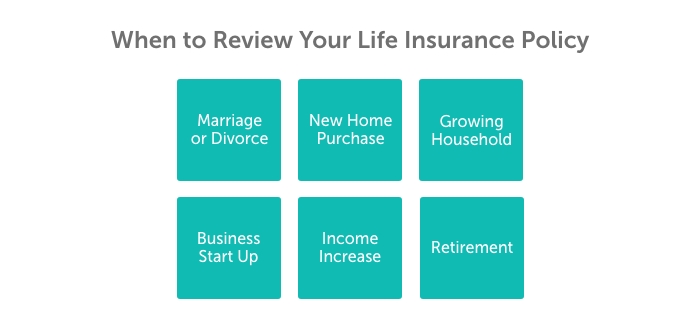

Life circumstances such as marriage, the birth of a child, a new job, or purchasing a home can significantly affect your financial responsibilities and the need for life insurance coverage. By reviewing your policy annually, you can make adjustments to reflect these changes and ensure that your loved ones are adequately protected.

Risk of Inadequate Coverage

Failing to review your life insurance quotes regularly can lead to underinsurance, where your policy may not provide enough coverage to meet your family’s financial needs in the event of your passing. This can leave your loved ones vulnerable and struggling to cover expenses such as mortgage payments, education costs, or daily living expenses.

Factors to Consider When Reviewing Life Insurance Quotes

When evaluating life insurance quotes, there are several key factors to keep in mind to ensure you have the right coverage for your needs. Changes in health, income, family situation, and external economic conditions can all impact your insurance requirements.

Health Status

- Changes in your health can affect the type of coverage you need.

- Health improvements may lead to lower premiums, while new health issues could result in higher rates.

Income Changes

- An increase in income may mean you need more coverage to protect your loved ones financially.

- A decrease in income could impact your ability to afford premiums, making it necessary to adjust your policy.

Family Situation

- Marriage, divorce, or the birth of a child can all impact your insurance needs.

- You may need to increase coverage to provide for new family members or adjust beneficiaries accordingly.

External Economic Factors

- Changes in interest rates or inflation can influence insurance rates.

- Economic downturns may lead to higher premiums, so it’s important to review your policy regularly.

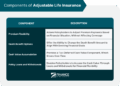

Benefits of Regularly Updating Your Life Insurance Policy

Updating your life insurance policy annually comes with several advantages that can help ensure you have adequate coverage and optimize costs and benefits.

Ensuring Adequate Coverage

- Life changes: Updating your policy annually allows you to account for any major life changes such as marriage, having children, buying a home, or starting a business. These changes may require adjustments to your coverage to adequately protect your loved ones.

- Financial obligations: As your financial obligations evolve over time, it’s important to review your policy to make sure the coverage amount is sufficient to cover outstanding debts, mortgage payments, and future expenses.

Optimizing Costs and Benefits

- Policy features: By reviewing your policy annually, you can assess if there are any new features or riders available that could enhance your coverage without significantly increasing your premiums.

- Competitive rates: Insurance markets are constantly changing, and by updating your policy regularly, you can compare rates from different insurers to ensure you are getting the best value for your money.

Tips for Effectively Comparing Life Insurance Quotes

When comparing life insurance quotes, it’s essential to consider various factors to ensure you select the best policy that meets your needs. Evaluating coverage, premiums, and policy terms can help you make an informed decision. Additionally, knowing how to negotiate with insurance providers based on your quote comparisons can potentially lead to better deals and savings.

Step-by-Step Guide for Comparing Different Life Insurance Quotes

- Obtain Multiple Quotes: Request quotes from different insurance providers to compare their offerings.

- Evaluate Coverage Options: Look at the types of coverage each policy offers and assess if they align with your financial goals and needs.

- Compare Premiums: Analyze the premium amounts for each policy and consider how they fit into your budget.

- Review Policy Terms: Understand the terms and conditions of each policy, including exclusions, limitations, and benefits.

Strategies for Negotiating with Insurance Providers

- Highlight Competitive Quotes: Use lower quotes from other providers as leverage to negotiate better terms with your preferred insurer.

- Ask for Discounts: Inquire about available discounts or promotions that can help reduce your premium costs.

- Customize Your Policy: Discuss customization options with the insurer to tailor the policy to your specific needs and potentially lower premiums.

- Seek Clarifications: Don’t hesitate to ask questions or seek clarifications on any aspects of the policy to ensure you fully understand the terms.

Last Word

In conclusion, reviewing your life insurance quote every year is not just a task but a proactive step towards ensuring your financial security. By understanding the significance of this practice, individuals can make well-informed choices that align with their evolving needs.

FAQ Summary

Why is it important to review life insurance quotes annually?

Reviewing life insurance quotes annually ensures that your coverage aligns with your current life situation, preventing underinsurance or overpayment.

What factors should be considered when reviewing life insurance quotes?

Key factors to consider include changes in health, income, family situation, and external factors like economic conditions that can impact insurance needs.

What are the benefits of updating your life insurance policy regularly?

Regularly updating your life insurance policy ensures adequate coverage for evolving needs, optimizes costs and benefits, and keeps you informed about the latest options.

How can one effectively compare life insurance quotes?

By following a step-by-step guide for comparing quotes, evaluating coverage, premiums, and policy terms, and using negotiation strategies based on comparisons.