Top 5 Ways to Get Lower Life Insurance Quotes Without Sacrificing Coverage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the nuances of life insurance quotes, coverage options, health and lifestyle improvements, discounts, and the role of independent agents creates a comprehensive guide to securing the best rates without compromising on coverage.

Ways to Lower Life Insurance Quotes

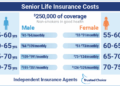

Life insurance quotes are estimates of the premium you will pay for a life insurance policy based on factors such as your age, gender, health status, lifestyle choices, and coverage amount. Lowering these quotes can help you save money while still ensuring adequate coverage for your loved ones in case of unexpected events.

Factors Influencing Life Insurance Premiums

- Your age: Younger individuals generally receive lower quotes as they are considered lower risk.

- Health status: Maintaining a healthy lifestyle and managing any existing health conditions can help lower your premiums.

- Occupation and hobbies: Risky occupations or hobbies can increase your quotes.

- Coverage amount: Higher coverage amounts lead to higher premiums.

Importance of Comparing Quotes

- Comparing quotes from different insurance providers allows you to find the best coverage at the most competitive price.

- Each provider may offer different rates and benefits, so it’s essential to explore your options.

Tips to Lower Quotes

- Maintain a healthy lifestyle by exercising regularly and eating a balanced diet.

- Avoid tobacco and excessive alcohol consumption to improve your health and lower your quotes.

- Consider term life insurance for a more affordable coverage option.

- Shop around and compare quotes from multiple insurance companies to find the best deal.

Choosing the Right Coverage

When it comes to choosing the right life insurance coverage, it is essential to understand the types of options available and how they align with your individual needs and financial goals.

Types of Life Insurance Coverage

- Term Life Insurance: Provides coverage for a specified period, usually 10, 20, or 30 years. It is generally more affordable but does not build cash value.

- Whole Life Insurance: Offers coverage for your entire life and includes a cash value component that grows over time. Premiums are typically higher compared to term life insurance.

Comparison of Term Life Insurance vs. Whole Life Insurance

- Cost: Term life insurance is usually more cost-effective, while whole life insurance premiums are higher due to the cash value component.

- Coverage: Whole life insurance provides lifelong coverage and a cash value component, whereas term life insurance only covers a specific period.

Determining the Appropriate Coverage Amount

- Consider your financial obligations, such as mortgage payments, debts, and future expenses like college tuition or retirement savings.

- Factor in your income, assets, and existing insurance coverage to determine the amount needed to provide financial security for your loved ones.

Varying Coverage Needs Based on Life Stage

- Young Adults: May require coverage to replace income, cover debts, and provide for dependents in case of premature death.

- Parents: Need coverage to protect children, cover expenses, and ensure financial stability for the family.

- Empty Nesters: Might focus on estate planning, covering final expenses, and leaving a legacy for heirs.

- Retirees: May need coverage for estate planning, final expenses, and potential tax liabilities.

Improving Your Health and Lifestyle

Improving your health and lifestyle can have a significant impact on the life insurance quotes you receive. Insurance companies often consider factors like smoking, weight, and pre-existing conditions when determining premiums. Making positive changes can help you secure lower insurance costs.

Strategies for Improving Health

- Quit smoking: Smoking is a major risk factor for various health conditions. By quitting smoking, you not only improve your health but also reduce insurance premiums.

- Maintain a healthy weight: Being overweight or obese can increase the risk of certain diseases. By adopting a balanced diet and regular exercise routine, you can improve your health and potentially lower insurance costs.

- Manage pre-existing conditions: If you have pre-existing conditions, such as high blood pressure or diabetes, managing them effectively can help reduce the impact on insurance premiums.

Effects of Health Factors on Premiums

- Smoking: Smokers are often charged higher premiums due to the increased health risks associated with smoking.

- Weight: Being overweight or obese can lead to higher premiums as it is linked to various health issues.

- Pre-existing conditions: Insurance companies may charge higher premiums for individuals with pre-existing conditions, as they are considered higher risk.

Tips for Maintaining a Healthy Lifestyle

- Exercise regularly: Engaging in physical activity can improve overall health and reduce the likelihood of chronic diseases.

- Eat a balanced diet: Consuming a variety of nutritious foods can help maintain a healthy weight and reduce the risk of health complications.

- Get regular check-ups: Keeping up with doctor visits and screenings can help detect any health issues early on, allowing for prompt treatment.

Benefits of Exercise and Diet on Premiums

- Exercise: Regular exercise can lower the risk of cardiovascular disease, diabetes, and other conditions, leading to potentially lower insurance premiums.

- Diet: A balanced diet rich in fruits, vegetables, whole grains, and lean proteins can help maintain a healthy weight and improve overall health, positively impacting insurance costs.

Utilizing Discounts and Incentives

When it comes to lowering your life insurance quotes without sacrificing coverage, taking advantage of discounts and incentives offered by insurance providers can be a game-changer. These discounts can help you save on premiums while still getting the coverage you need.

Common Discounts Offered by Insurance Providers

- Multi-policy Discount: Insurance companies often offer discounts when you bundle multiple policies, such as life insurance, auto insurance, and homeowners insurance, with them.

- Non-smoker Discount: If you are a non-smoker, you may be eligible for lower premiums compared to smokers.

- Healthy Lifestyle Discount: Some insurers provide discounts for maintaining a healthy lifestyle, such as regular exercise and a balanced diet.

Bundling Policies for Cost Savings

- Bundling your life insurance policy with other insurance policies from the same provider can lead to significant cost savings.

- Insurance companies are more likely to offer discounts on bundled policies as it increases customer loyalty and retention.

Loyalty Programs and Incentives

- Many insurance providers offer loyalty programs that reward customers who stay with them for an extended period with lower premiums or other incentives.

- These incentives can include cashback rewards, premium discounts, or additional coverage options at no extra cost.

Maintaining a Good Credit Score

- Your credit score can play a significant role in determining your insurance premiums.

- Insurance companies may offer lower rates to individuals with good credit scores as they are considered lower risk.

- Improving your credit score by paying bills on time and reducing debt can help you secure lower life insurance quotes.

Working with an Independent Insurance Agent

When it comes to finding lower life insurance quotes without sacrificing coverage, working with an independent insurance agent can be a game-changer. These professionals have the expertise and resources to help you navigate the complex world of insurance to find the best deals tailored to your needs.

Role of an Independent Insurance Agent

Independent insurance agents work with multiple insurance companies, giving them access to a wide range of policies and prices. They can help you compare quotes from different providers and identify the most cost-effective options without compromising on coverage.

Personalized Advice Based on Individual Needs

One of the key benefits of working with an independent agent is the personalized advice they can offer. By understanding your unique requirements and financial situation, they can recommend insurance solutions that align with your specific needs and budget.

Effective Communication with Your Agent

When working with an independent insurance agent, it’s crucial to clearly communicate your requirements and expectations. Be open and honest about your health, lifestyle, and financial circumstances so that your agent can tailor their recommendations accordingly.

Navigating the Insurance Market for Best Deals

Independent agents have a deep understanding of the insurance market and can help you navigate the complexities to find the best deals available. They stay up-to-date on industry trends and can leverage their knowledge to negotiate competitive rates on your behalf.

Summary

In conclusion, mastering these top 5 ways to lower life insurance quotes without sacrificing coverage empowers individuals to make informed decisions and secure financial protection that aligns with their needs. By following these strategies, you can navigate the complexities of life insurance with confidence and peace of mind.

Detailed FAQs

What factors influence life insurance premiums the most?

Factors like age, health status, occupation, and lifestyle choices have a significant impact on life insurance premiums. Insurers assess these factors to determine the level of risk associated with providing coverage.

Is term life insurance more affordable than whole life insurance?

Yes, term life insurance tends to be more cost-effective compared to whole life insurance, as it provides coverage for a specified term rather than the entire lifetime.

How can I improve my health to lower insurance costs?

Adopting healthy habits like regular exercise, maintaining a balanced diet, and avoiding habits like smoking can positively impact your health and lead to lower insurance premiums.

What role does a good credit score play in securing lower insurance quotes?

A good credit score reflects financial responsibility and can help in securing lower insurance quotes, as insurers may view individuals with higher credit scores as lower risk.

Why is it important to compare quotes from different providers?

Comparing quotes from different providers allows individuals to find the best rates and coverage options that suit their needs. It helps in making an informed decision before committing to a policy.