How to Choose the Right Coverage Amount from Your Life Insurance Quote sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

When considering life insurance coverage, it’s essential to strike a balance between meeting your family’s financial needs and securing their future. This guide will walk you through the key factors to consider and help you navigate the complex terrain of coverage types and estimation.

Factors to Consider

When choosing the right coverage amount from your life insurance quote, it is essential to consider various factors that can impact the financial security of your loved ones in your absence. Understanding your financial obligations and goals is crucial in determining the appropriate coverage amount to ensure your family’s well-being.

Financial Obligations for Your Loved Ones

- Consider the cost of living expenses, such as daily necessities, utility bills, and education expenses for your children.

- Factor in any outstanding debts, including credit card debt, car loans, or student loans, that would need to be paid off.

- Think about long-term financial goals, such as saving for retirement or funding your children’s college education.

Current Financial Situation and Future Goals

- Assess your current income, savings, and investments to determine how much financial support your family would need in your absence.

- Consider any future financial goals, such as buying a home, starting a business, or traveling, that may require additional financial resources.

- Review your budget and expenses to understand your financial commitments and ensure adequate coverage to meet those needs.

Outstanding Debts or Mortgages

- Calculate the total amount of outstanding debts, including mortgages, personal loans, and other financial obligations that would need to be settled.

- Ensure that the coverage amount is sufficient to pay off all debts and provide financial stability for your family in the event of your passing.

- Consider the impact of inflation and future expenses when determining the coverage amount to account for changing financial needs over time.

Understanding Coverage Types

When choosing the right coverage amount from your life insurance quote, it’s essential to understand the different types of coverage available to you. Two common types of life insurance are term life insurance and whole life insurance, each with its own features and benefits.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, the beneficiaries receive the death benefit. However, if the policyholder outlives the term, the coverage expires, and there is no payout.

- Example: A 35-year-old individual purchases a 20-year term life insurance policy with a death benefit of $500,000. If the individual passes away within the 20-year term, the beneficiaries receive the $500,000 payout.

Term life insurance is generally more affordable compared to whole life insurance, making it an attractive option for individuals looking for temporary coverage.

Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the policyholder. In addition to the death benefit, whole life insurance also includes a cash value component that grows over time. Policyholders can borrow against this cash value or use it to pay premiums.

- Example: A 45-year-old individual purchases a whole life insurance policy with a death benefit of $250,000. As long as the premiums are paid, the coverage remains in effect for the individual’s entire life, and the cash value continues to grow.

Whole life insurance offers lifelong coverage and a cash value component, but it is typically more expensive than term life insurance.

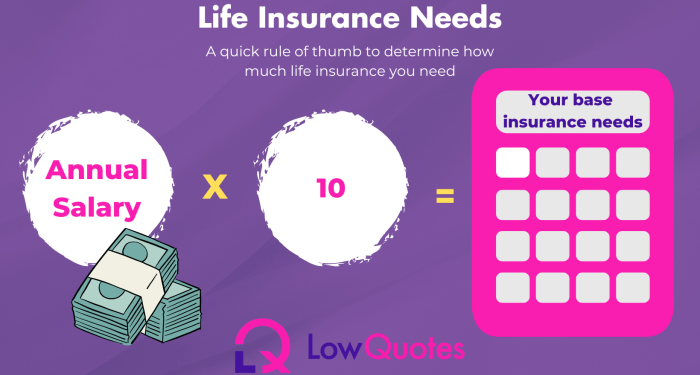

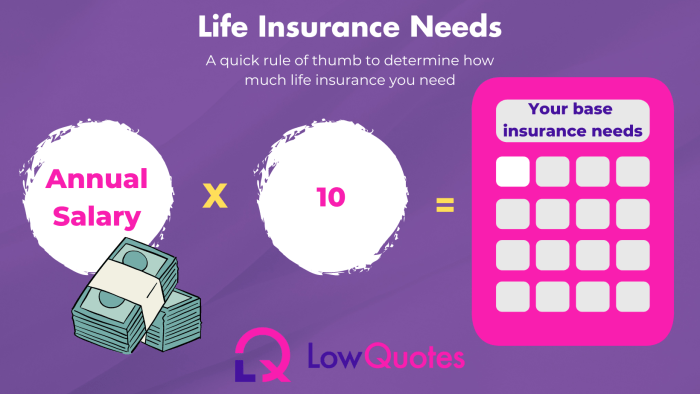

Estimating Coverage Needs

When determining the right coverage amount for your life insurance policy, it is essential to estimate your coverage needs accurately. This involves designing a budget to understand how much your family would require to maintain their current lifestyle, as well as planning for future expenses that may arise.To estimate your coverage needs effectively, consider the following factors:

Design a Budget

- Start by analyzing your current expenses and income to determine the financial support your family would need in case of your absence.

- Calculate the amount required to cover essential costs such as mortgage payments, utilities, groceries, and other day-to-day expenses.

- Factor in any outstanding debts, such as loans or credit card balances, that would need to be paid off.

- Consider additional expenses like childcare, education costs, or healthcare expenses that your family may incur.

List of Future Expenses

- Create a comprehensive list of future expenses that your family may face, such as college tuition for your children, wedding expenses, or retirement savings.

- Estimate the total amount needed for each of these expenses and add them up to determine the overall financial requirement.

- Consider the timeline for these expenses to occur, as this will help you prioritize and plan for adequate coverage at the right time.

Consultation and Review

Consulting with a financial advisor or insurance agent is crucial when it comes to choosing the right coverage amount from your life insurance quote. These professionals have the expertise to help you navigate through the complex world of insurance and make informed decisions that align with your financial goals.

Importance of Consulting

- Financial advisors can assess your current financial situation, future needs, and risk tolerance to determine the appropriate coverage amount.

- Insurance agents can explain the different coverage options available and help you understand the terms and conditions of each policy.

- Consulting with experts can prevent you from being underinsured or overinsured, ensuring that you have the right amount of coverage for your specific circumstances.

Benefits of Regular Review

- Regularly reviewing your coverage amount allows you to make adjustments based on changes in your financial situation, such as marriage, the birth of a child, or a career advancement.

- By reviewing your coverage regularly, you can ensure that your life insurance aligns with your current needs and goals, providing adequate protection for your loved ones.

- Regular reviews also help you take advantage of any new insurance products or discounts that may be available, ensuring that you are getting the best coverage at the most competitive rates.

Adjusting Coverage Amount

- Consider increasing your coverage amount if you have taken on additional debt, such as a mortgage, or if your family’s financial needs have grown.

- Conversely, you may be able to decrease your coverage amount if you have paid off significant debts or if your children have become financially independent.

- It’s important to reassess your coverage amount regularly to ensure that it continues to meet your needs and provides adequate protection for your loved ones.

Closing Summary

As you embark on the journey of choosing the right coverage amount from your life insurance quote, remember that careful consideration and planning can provide peace of mind and financial security for your loved ones. By understanding your needs, consulting with experts, and regularly reviewing your coverage, you can make informed decisions that protect your family’s well-being in the long run.

Question Bank

What factors should I consider when choosing the right coverage amount?

You should consider your family’s financial obligations, your current and future financial situation, and any outstanding debts or mortgages that need to be paid off.

What are the differences between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance covers you for your entire life. Term life insurance is usually more affordable, but whole life insurance offers cash value accumulation.

How can I estimate my coverage needs effectively?

Design a budget to maintain your family’s lifestyle, list future expenses like college tuition or retirement savings, and create a timeline for when these expenses would occur to estimate the coverage amount needed.

Why is it important to consult with a financial advisor or insurance agent?

Consulting with experts can help you make informed decisions, understand complex insurance terms, and ensure you have the right coverage amount for your needs.

How often should I review my coverage amount?

It’s recommended to review your coverage amount annually or whenever your financial situation changes, such as marriage, having children, or buying a house.