Embarking on the journey of understanding Life Insurance Quote for Seniors: What You Need to Know, this introductory paragraph aims to draw in the readers with valuable insights on the topic.

Detailing the nuances and complexities of life insurance for seniors, this paragraph sets the stage for an informative discussion ahead.

Understanding Life Insurance for Seniors

Life insurance is crucial for seniors as it provides financial protection for loved ones and helps cover final expenses. It ensures that beneficiaries receive a death benefit upon the policyholder’s passing, offering peace of mind and security.

Key Differences in Life Insurance for Seniors

- Age: Seniors typically pay higher premiums due to increased risk and age-related health concerns.

- Coverage Amount: Seniors may require smaller coverage amounts as financial obligations decrease with age.

- Medical Underwriting: Seniors may undergo more stringent medical examinations compared to younger individuals.

Factors Seniors Should Consider When Choosing a Policy

- Health Condition: Seniors should assess their health status to determine the type of policy that suits their needs.

- Financial Goals: Consider whether the policy aligns with financial objectives and provides adequate coverage.

- Length of Coverage: Decide between term or permanent life insurance based on individual circumstances and preferences.

Types of Life Insurance for Seniors

When it comes to life insurance for seniors, there are different types available to meet varying needs and preferences. The two main types are term life insurance and whole life insurance. Each type has its own unique features, benefits, and considerations to keep in mind when choosing the right policy.

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. The premiums are typically lower compared to whole life insurance because it offers coverage for a set term only. This type of insurance is ideal for seniors who want coverage for a certain period, such as until retirement or until a mortgage is paid off.

However, it does not build cash value like whole life insurance.

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual. The premiums are generally higher than term life insurance but remain level throughout the policy’s lifetime. Whole life insurance also accumulates cash value over time, which can be borrowed against or used for other financial needs.

This type of insurance is suitable for seniors looking for lifelong coverage and an investment component.

Factors Affecting Life Insurance Quotes for Seniors

When it comes to obtaining life insurance as a senior, several factors can influence the quotes you receive. Understanding these factors is crucial in making informed decisions about your coverage.

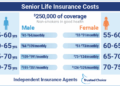

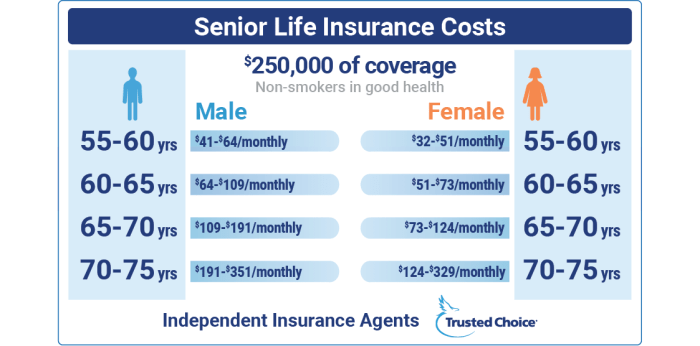

Age Impact on Life Insurance Quotes

As seniors age, the cost of life insurance typically increases. This is because advanced age is associated with a higher risk of mortality, making insurers more cautious in offering affordable premiums to older individuals. The older you are when you apply for life insurance, the higher your premiums are likely to be.

Health Conditions and Cost of Life Insurance

Health conditions play a significant role in determining the cost of life insurance for seniors. Pre-existing medical conditions can increase the risk for insurers, leading to higher premiums or possible denial of coverage. Individuals with serious health issues may be considered high-risk applicants, resulting in higher insurance costs.

Other Factors Affecting Quotes for Seniors

In addition to age and health conditions, several other factors can impact the quotes seniors receive for life insurance policies. These may include lifestyle choices, such as smoking or engaging in high-risk activities, as well as the type and amount of coverage desired.

Insurers will also consider factors like gender, family medical history, and even the applicant’s driving record in assessing the overall risk profile.

How to Obtain Life Insurance Quotes for Seniors

When it comes to obtaining life insurance quotes for seniors, there are a few key steps to keep in mind. It’s essential for seniors to understand the process and take the necessary precautions to ensure they get the best possible quote for their needs.

Comparing Quotes from Multiple Insurance Providers

It’s crucial for seniors to compare quotes from multiple insurance providers before making a decision. By obtaining quotes from different companies, seniors can get a better understanding of the range of prices and coverage options available to them. This will help them make an informed decision based on their specific needs and budget.

Tips for Seniors to Ensure They Get the Best Life Insurance Quote

- Provide accurate information: Seniors should ensure that they provide accurate information when applying for life insurance. Any discrepancies or inaccuracies could lead to higher quotes or even denial of coverage.

- Consider term vs. permanent insurance: Seniors should understand the difference between term and permanent life insurance and choose the option that best suits their needs and budget.

- Maintain good health: Leading a healthy lifestyle can positively impact life insurance quotes for seniors. Seniors should try to maintain a healthy weight, exercise regularly, and avoid smoking to potentially lower their premiums.

- Work with an independent agent: Seniors can benefit from working with an independent insurance agent who can help them navigate the process, compare quotes, and find the best policy for their individual situation.

- Review and update coverage regularly: Seniors should review their life insurance coverage regularly to ensure it still meets their needs as they age. Life changes, such as marriage, divorce, or the birth of grandchildren, may require adjustments to their policy.

Benefits and Drawbacks of Life Insurance for Seniors

Life insurance can provide numerous benefits for seniors, offering financial security and peace of mind for themselves and their loved ones. However, there are also drawbacks and limitations that seniors should consider before purchasing a policy. Additionally, understanding how life insurance can impact estate planning is crucial for seniors to make informed decisions.

Benefits of Life Insurance for Seniors

- Financial Security: Life insurance can provide a tax-free payout to beneficiaries, ensuring they are financially supported after the policyholder’s passing.

- Cover Final Expenses: Seniors can use life insurance benefits to cover funeral costs, medical bills, and other end-of-life expenses.

- Legacy Planning: Life insurance allows seniors to leave a financial legacy for their loved ones, helping secure their future.

- Peace of Mind: Knowing that their family will be taken care of financially can provide seniors with peace of mind and reduce stress.

Drawbacks and Limitations of Life Insurance for Seniors

- Cost: Life insurance premiums can be expensive for seniors, especially if they have pre-existing health conditions.

- Health Restrictions: Some policies may have health restrictions or require medical exams, making it challenging for seniors with health issues to qualify.

- Coverage Limitations: Certain policies may have limitations on coverage amounts or specific exclusions that seniors need to be aware of.

- Policy Lapse: If seniors are unable to keep up with premium payments, their policy may lapse, resulting in loss of coverage.

Impact on Estate Planning

Life insurance can play a significant role in estate planning for seniors. The death benefit from a life insurance policy can be used to pay estate taxes, debts, or other financial obligations, ensuring that the estate is preserved for beneficiaries.

It can also help equalize inheritances among family members and provide liquidity to cover expenses without the need to sell assets.

Closing Notes

Wrapping up the discussion on Life Insurance Quote for Seniors: What You Need to Know, this final paragraph offers a comprehensive summary of the key points discussed, leaving readers with a clear understanding of the topic.

FAQ Summary

How does age impact life insurance quotes for seniors?

Age is a significant factor in determining life insurance quotes for seniors, with premiums generally increasing as individuals get older. Insurers consider age as a risk factor affecting longevity and health.

Why is it important to compare quotes from multiple insurance providers?

Comparing quotes helps seniors find the best coverage at the most competitive rates. Different insurers offer varying premiums and benefits, so exploring multiple options ensures a well-informed decision.

How can life insurance impact estate planning for seniors?

Life insurance can play a crucial role in estate planning for seniors by providing financial security to beneficiaries, covering outstanding debts, and facilitating a smooth transfer of assets. It can also help offset potential tax liabilities.