Life Insurance Quotes for Families: Affordable Options Explained takes center stage, inviting readers into a world of valuable insights and information. This passage ensures a comprehensive and engaging exploration of the topic, guaranteeing a rewarding read for all.

The subsequent paragraph will delve deeper into the specifics, shedding light on various aspects of life insurance for families.

Introduction to Life Insurance Quotes for Families

Life insurance is a financial safety net that provides a lump sum payment to your loved ones in the event of your death. It helps ensure that your family members are taken care of financially when you are no longer there to provide for them.

Having life insurance is crucial for families as it offers peace of mind knowing that your loved ones will have financial security in case of your untimely passing. It can help cover expenses such as mortgage payments, children’s education, daily living costs, and even funeral expenses.

Benefits of Life Insurance for Families

- Financial Protection: Life insurance provides a tax-free lump sum payment to your beneficiaries, ensuring that they are financially secure after your passing.

- Debt Repayment: Your life insurance payout can be used to pay off any outstanding debts, such as mortgages, loans, or credit card balances, relieving your family from financial burdens.

- Income Replacement: The death benefit from a life insurance policy can replace your income, ensuring that your family’s standard of living is maintained even after you are gone.

- Estate Planning: Life insurance can help with estate planning by providing liquidity to cover estate taxes and other expenses, ensuring a smooth transfer of assets to your heirs.

Types of Life Insurance Policies

Life insurance policies come in various forms, each with its own set of features and benefits. When it comes to families, two common types of life insurance to consider are term life insurance and whole life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. This type of policy is often more affordable than whole life insurance, making it a popular choice for families looking for temporary financial protection.

Term life insurance pays out a death benefit if the insured passes away during the term of the policy, providing financial security for beneficiaries.

Whole Life Insurance

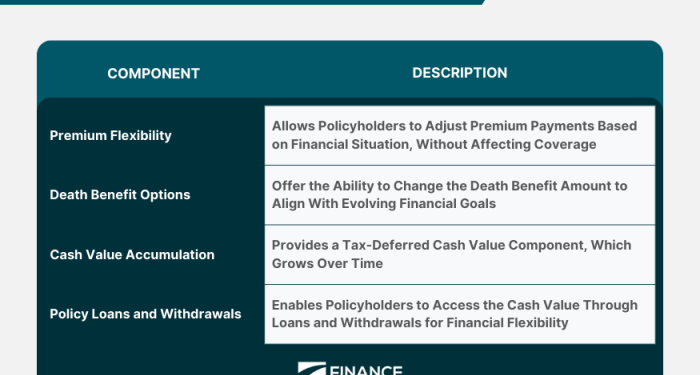

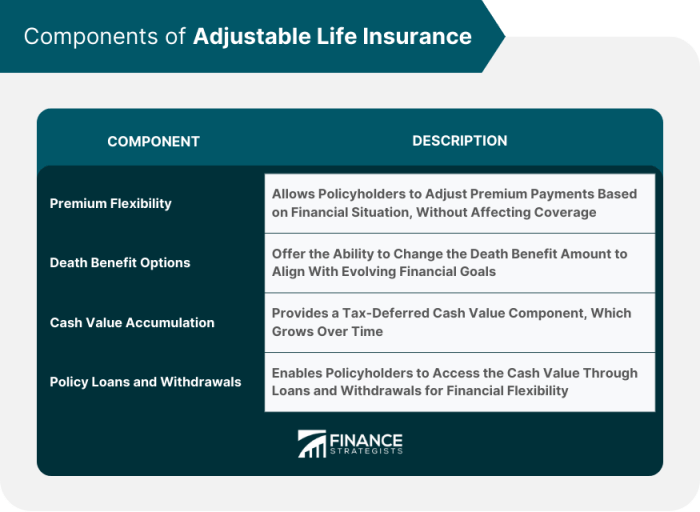

On the other hand, whole life insurance offers coverage for the entire lifetime of the insured individual. Unlike term life insurance, whole life insurance also includes a cash value component that grows over time. This cash value can be accessed by the policyholder through loans or withdrawals, providing a form of savings in addition to life insurance coverage.

Comparison of Term Life Insurance and Whole Life Insurance for Families

When deciding between term life insurance and whole life insurance for families, it’s essential to consider factors such as cost, coverage duration, and potential savings. Term life insurance is generally more affordable and provides coverage for a specific period, making it suitable for families looking for temporary protection.

On the other hand, whole life insurance offers lifelong coverage and a cash value component, making it a more long-term financial planning tool. Families should carefully assess their needs and financial goals to determine which type of life insurance policy best suits their situation.

Factors Affecting Life Insurance Quotes

When it comes to obtaining life insurance quotes for families, there are several key factors that can influence the cost of coverage. Factors such as age, health status, coverage amount, and policy term all play a significant role in determining the premiums for life insurance policies.

Age and Health Impact

Age and health are two of the most crucial factors that can impact life insurance premiums. Generally, younger and healthier individuals are considered lower risk by insurance companies, leading to lower premiums. As individuals age or develop health conditions, the risk of mortality increases, resulting in higher premiums to compensate for the higher risk to the insurer.

- Younger individuals typically enjoy lower premiums due to their lower risk of mortality.

- Health conditions such as chronic illnesses or risky behaviors can lead to higher premiums.

- Undergoing regular health check-ups and maintaining a healthy lifestyle can help in securing more affordable life insurance quotes.

Coverage Amount and Policy Term

The coverage amount and policy term chosen also significantly impact life insurance costs. The higher the coverage amount, the higher the premiums, as the insurer will have to pay out a larger sum in the event of a claim. Similarly, longer policy terms tend to have higher premiums compared to shorter terms.

- Choosing a coverage amount that adequately meets your family’s financial needs is essential but can impact the cost of the policy.

- Shorter policy terms may be more affordable but may not provide coverage for as long as needed.

- It is crucial to strike a balance between coverage amount, policy term, and affordability when selecting a life insurance policy for your family.

Finding Affordable Life Insurance Options

When it comes to securing life insurance for your family, affordability is a key factor to consider. Here are some tips to help you find affordable life insurance options:

Comparing Quotes from Different Insurance Companies

One of the most effective ways to find affordable life insurance is by comparing quotes from different insurance companies. Each company has its own set of criteria for determining rates, so it’s essential to shop around and see which one offers the best value for your needs.

Bundling Insurance Policies for Cost Savings

Another way to save on life insurance is by bundling your policies. Many insurance companies offer discounts when you purchase multiple policies from them, such as combining your life insurance with auto or home insurance. This can lead to significant cost savings for your family in the long run.

Customizing Life Insurance Policies for Families

When it comes to life insurance, families have unique needs that may require customization of their policies to ensure adequate coverage. Here’s how families can tailor their life insurance policies to suit their specific situations:

Adding Riders for Extra Coverage

One way families can customize their life insurance policies is by adding riders. Riders are additional provisions that can be attached to a basic life insurance policy to provide extra coverage for specific needs. For example, a family with young children may opt to add a child rider to their policy, which would provide coverage in the event of a child’s death.

Choosing the Right Coverage Amount

It’s essential for families to determine the right coverage amount based on their financial responsibilities and future needs. Factors such as outstanding debts, mortgage payments, children’s education expenses, and the family’s lifestyle should all be considered when customizing a life insurance policy.

Considering Term vs. Permanent Insurance

Families should also decide whether term life insurance or permanent life insurance is the best option for them. Term life insurance provides coverage for a specified period, while permanent life insurance offers lifelong protection. Depending on the family’s needs and budget, they can choose the most suitable type of coverage.

Reviewing and Updating Coverage Regularly

Life insurance needs can change over time, so it’s crucial for families to review and update their coverage regularly. Major life events such as getting married, having children, buying a home, or changing jobs may necessitate adjustments to the policy to ensure adequate protection.

Final Wrap-Up

In conclusion, Life Insurance Quotes for Families: Affordable Options Explained offers a comprehensive overview of the topic, leaving readers with a clear understanding and a sense of empowerment in navigating life insurance choices for their families.

FAQ Explained

What factors influence life insurance quotes for families?

Factors such as age, health, coverage amount, and policy term can significantly impact life insurance premiums for families.

Why is it important to compare quotes from different insurance companies?

Comparing quotes allows families to find the most affordable options tailored to their needs, ensuring they make an informed decision.

How can bundling insurance policies lead to cost savings for families?

Bundling insurance policies often results in discounts from insurance companies, ultimately reducing the overall cost for families.